If you die without proper estate planning, your estate will pass to your next of kin by what is known as “intestate succession.” Intestate succession is a set of default rules that dictates who will receive your estate if you fail to make these arrangements ahead of time. These rules, in a sense, are a default last will and testament prepared on your behalf by the State of Michigan. Unfortunately, however, these default rules do not always meet everyone’s needs and often result in unintended consequences. This is particularly true in second marriages or blended families where the rules of intestate succession can result in an accidental disinheritance of one’s children. The avoidance of these sometimes harsh and undesirable outcomes is one of the many reasons people create an estate plan.

The Spouse’s Share

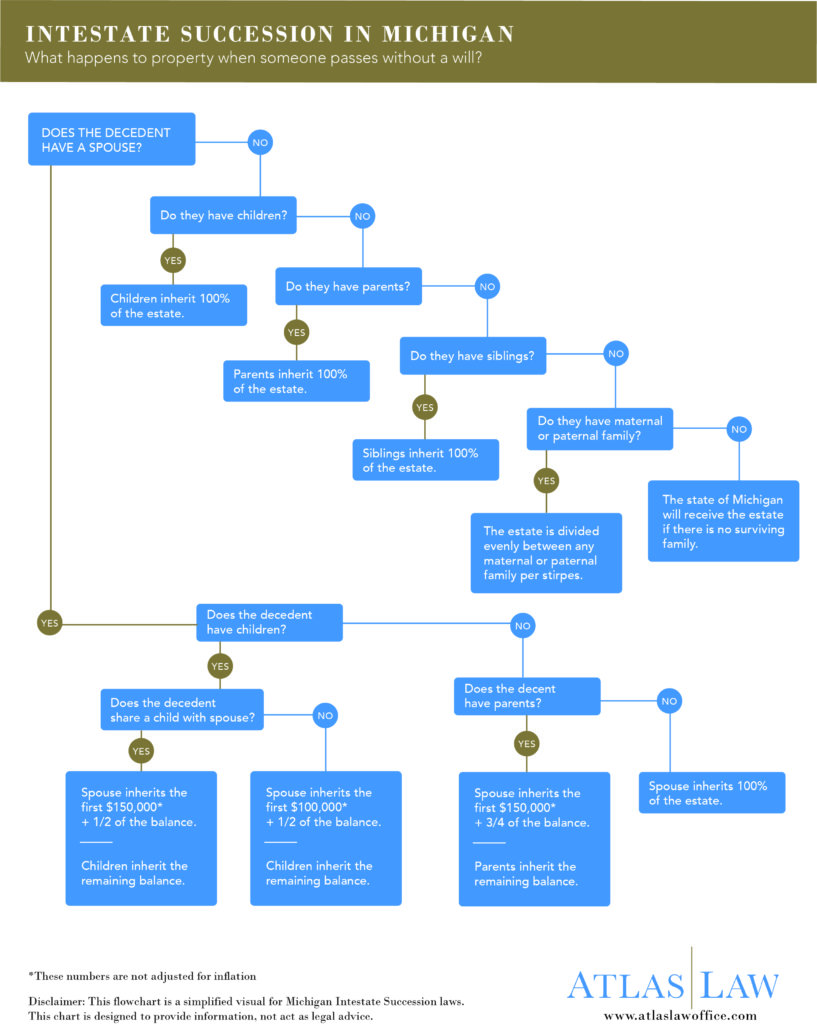

Married couples often assume that without planning, all of their estate will simply pass to their spouse, but this is not always the case. In Michigan, under the laws of intestacy, the share the surviving spouse will receive depends on whether you have living descendants (children, grandchildren, etc.) and whether you have a surviving parent. If you have neither a surviving parent nor descendants, then your spouse will receive your entire estate.

Parents But No Children

If you have a surviving parent (but no descendants), then your spouse will receive the first $150,000* of your intestate estate and 3/4 of the balance. Your parent or parents will receive the remaining balance.

You And Your Spouse Share At Least One Descendant

If you share at least one common descendant (child, grandchild, etc) with your spouse, then your spouse will receive the first $150.000* of the intestate property and 1/2 of the balance. Your descendants will receive the remainder of the intestate estate.

You And Your Spouse Do Not Share Any Descendants

If you die with at least one descendant but you do not share a common descendant with your spouse, then your spouse will receive the first $100.000* of the intestate property and 1/2 of the balance. Your descendants will receive the remainder of the intestate estate.

Intestate Succession Flow Chart

This Intestate Succession Flow Chart is a very simplified view of the often complicated rules. Another example can be found on The Wayne County Probate Court’s website. The full rules can be found on the Michigan Legislature’s website.

How to Avoid Avoid Intestate Succession

The rules of intestate succession do not always end with a desirable result. Fortunately, you can avoid the application of these rules to your estate in a number of ways. A qualified estate planning attorney has many tools that can help prevent the sometimes unintended consequences of an intestate estate. Perhaps the most common tool is a revocable trust. However, this not the only tool available. Lady Bird Deeds can also help prevent an estate from passing by intestate succession and further help to avoid the need for a probate entirely. Our firm is experienced in helping individuals and families develop a comprehensive estate plan to ensure your property passes to your intended heirs.

Atlas Law is a five star rated law firm. We serve Plymouth, Livonia, Westland, Garden City, Northville, Novi, Canton, and Farmington Hills. Contact us today!

We offer free consultations. Call today (248) 773-5555

About the Author: Aaron R. Shahan is an attorney at Atlas Law, PLC. Aaron dedicates his practice to virtually all aspects of estate planning, elder law, and probate.

*The amounts provided are adjusted each year for cost of living. The amounts provided in this article are based on the amounts for 2000 or earlier. Cost-of-living adjustments are published annually by the Department of Treasury. As a result, the amounts provided above have been adjusted.