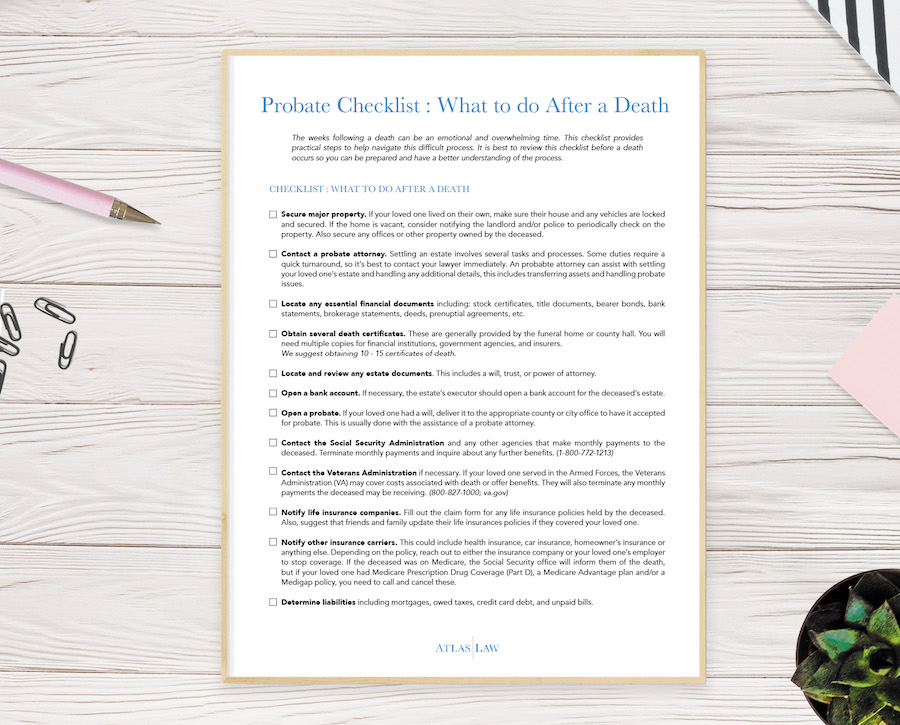

Probate Checklist: What to do After a Death

Dealing with the death of a loved one can be an overwhelming and emotional experience. This probate checklist provides practical advice to help navigate this difficult process, including important steps in the weeks following a death as well as ways to be prepared.